The Great Trade Down

When is good, good enough? The Great Trade-down represents a shifting of consumer mindset, in which they are still buying the things they want, but they are making a different decision on where to go and how. For example, if you’re used to buying your tee shirts at a luxury department store, maybe now you […]

When is good, good enough?

The Great Trade-down represents a shifting of consumer mindset, in which they are still buying the things they want, but they are making a different decision on where to go and how. For example, if you’re used to buying your tee shirts at a luxury department store, maybe now you are buying at a mid-tier store. The mid-tier shopper will trade down to buying their tees at a big box store. If you are used to buying organic milk, maybe you’re buying regular milk. And so on. Retail last saw this behavior in 2008. In an environment of rising prices, the question is “when is good, good enough?”

Consumer spending is an indicator of sentiment and loyalty

Right now, consumers are still spending their behavior has changed. In August, we saw a 0.3% increase in US retail sales. Looking at how people are spending may be telling of their sentiment and loyalty.

Rakuten insights from the apparel category show that today’s consumers are more willing to step outside their favored brands and retailers for better prices. Shoppers who prefer elevated brands are trading down the most, nearly 30% more than during the pandemic induced recession of 2020.

This trade down behavior is hitting certain retailers hard while others benefit. Let’s look at this by tier.

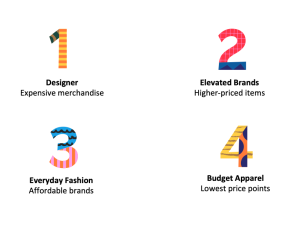

Rakuten investigated shopper behavior in our own apparel category to learn more, defining the tiers as follows and excluding high end luxury from the analysis.

Designer brands are sitting pretty. Consumers who can afford expensive designer merchandize continue to spend. Shoppers at tier 1 retailers are trading down 38% less often than in 2021 and 53% less often than in 2020.

Elevated brands bear the brunt. Consumers are replacing higher-priced popular brands with affordable options more often. Shoppers at tier 2 retailers are trading down 15% more often than in 2021 and 28% more often than in 2020.

Everyday fashion retailers are managing. Consumers of affordable, every day fashion are hanging around. Tier 3 retailers may be able to hold onto shoppers with perks and incentives. Shoppers at tier 3 retailers are trading down 8% more often than in 2021 and 18% more often than in 2020.

Budget apparel retailers are winning. Tier 4 retailers who offer the lowest price points of either mass-produced or discount apparel have seen 12% consumer growth since 2021, attributed to trade down behavior.

*Rakuten internal data. Data compares shopping trends from January through April to May through August of each year

We’ll be watching how they respond during the Holiday shopping season as inflationary pressures continue. Check back for more insights from us as the story evolves!