Cash Back is a precision tool

The past few months have been an interesting economic ride. Typically, when there is high inflation, consumers react by spending less. But they’ve done the exact opposite. Consumers have continued to spend, despite inflation and we’ve seen monthly retail spend keep pace with inflationary activity.

Consumers are still spending but their loyalty is fleeting

The past few months have been an interesting economic ride. Typically, when there is high inflation, consumers react by spending less. But they’ve done the exact opposite. Consumers have continued to spend, despite inflation and we’ve seen monthly retail spend keep pace with inflationary activity.

Right now, consumers are still spending, but they’re starting to evaluate their choices and making tradeoffs. In an environment of rising prices, the question is “when is good, good enough?”. We call this, The Great Trade Down. It represents a shifting of consumer mindset, in which they are still buying the things they want but they are making a different decision on where and how. This is important because it means that people aren’t cutting their spending. Rather, they’re choosing to spend differently. And where they put that spend is anyone’s game.

We all tried new brands during the pandemic. Initially driven out of necessity, or lack of availability, but there has been a measurable, lasting shift in consumer behavior. 90% of consumers who changed brands during the pandemic continue to try new things.

People are a lot more open to new things, especially if they are met with good pricing paradigms. This can work for and against brands.

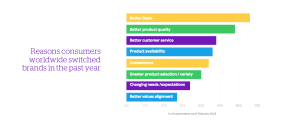

Consumers are actively seeking better deals but not at the expense of quality

Two-thirds of consumers who switched brands in the past year, were looking for better deals. The second driver for brand switching, was better product quality. This demonstrates our earlier point about evaluating and making tradeoffs. People are looking for the better deals and quality – based on their need. We can infer that right now, drivers like brand sentiment and affinity will only go so far.

This makes the road to acquisition a bit harder, and more costly. While it’s important to meet in market demand and deliver the deals and value consumers are looking for, getting into a pricing competition is a race to the bottom. It’s not sustainable for profitability and won’t work to retain customers or build loyalty.

Source: Emarketer, The top reasons consumers switch brands May 27, 2022

Brands are met with both an opportunity – capture their share of wallets and shoppers – and a challenge. Retain their customers. So, we need to ask ourselves two important questions to help meet the opportunity and address the challenge. First, how do brands and retailers retain their existing customer base? Then, how do they get more long-term, high-value shoppers from paid acquisition tactics?

Cash Back is the Answer.

Cash Back is a precision tool, while discounting is a blunt object. Consumers are looking for value in this market, and Cash Back allows brands and retailers to change behavior efficiently. One of Cash Back’s biggest strengths is that it can act as a lever to drive full price, a critical point-of-focus given the ongoing need to manage inventory issues.

Cash Back is elastic and when deployed through Rakuten, its data driven. We take internal and external factors such as industry, brand value, seasonality, competitive and shopper behavior into account to determine the right rate for a business, as well as how and when to optimize those rates based on performance. At Rakuten, we refer to Cash Back elasticity as Dynamic Cash Back.

Dynamic Cash Back drives 29% more sales and increases conversion by 27%.

Determining the most effective rate impacts, even changes, shopper behavior from acquisition to conversion, builds loyalty and can nurture long-term value. On Rakuten, Dynamic Cash Back drives 29% more sales and increases conversion by 27%, versus stagnant Cash Back. As an acquisition tactic, Cash Back acts as a strong incentive to gain and convert new shoppers.

As we think about moving from acquisition to building customer loyalty, it’s important to understand how to influence behavior and strengthen performance at each point in the customer journey.

We’ve examined the impact of dynamic Cash Back on activating new shoppers, driving them to 2nd and 3rd purchase, re-engaging lapsed shoppers and finally nurturing loyalty and retention from buyers. Examining the full customer journey to understand which CB rates are most performant, allows brands to provide a planned shopper experience that increases purchase and retains buyers. It also provides actionable insight that brands can use to get more precise in understanding who to target, and at which rate, to drive specific outcomes.

The takeaways

- Consumers are still spending but their loyalty is fleeting – Cash Back can change consumer behavior efficiently for brands and become a lever to drive full price.

- Dynamic Cash Back Fuels the customer journey – Strategically bridges acquisition and loyalty, providing actionable insight that brands can use to get more precise in understanding who to target, and at which rate, to drive specific outcomes.

- Dynamic Cash back drives performance – In general, it drives 29% more sales and increases conversion by 27%.